Cairo – Decypha: With the hydrocarbon industry dominating the Middle Eastern economy, the plummeting oil prices have necessitated the diversification of governments’ revenue streams. During the oil slump aftermath and its negative impact on the economy, the Gulf Cooperation Council (GCC) member countries have decided to implement a value-added tax (VAT) –effective January 2018—at a rate of 5%. VAT. An indirect tax, it is a general consumption tax, one of the most commonly used tax by governments around the world to pad its coffers.

The GCC VAT framework agreement, signed by all the GCC member countries – UAE, Kuwait, Oman, Qatar, Saudi Arabia, and Bahrain – provides broad principles of the added tax while giving each country some leeway in its adoption. Each GCC member will adopt its own domestic legislation with the underlying framework as broad guidelines. While the VAT is planned to be implemented from January 1st, all member countries will have until January 1, 2019 to fully adopt the tax.

The GCC, heavily dependent on the oil sector, has long planned to adopt the sales tax to increase its non-oil revenues following ongoing recommendations by the International Monetary Fund to diversify revenue streams. This agreement will reduce government dependence on energy income.

A Deeper look

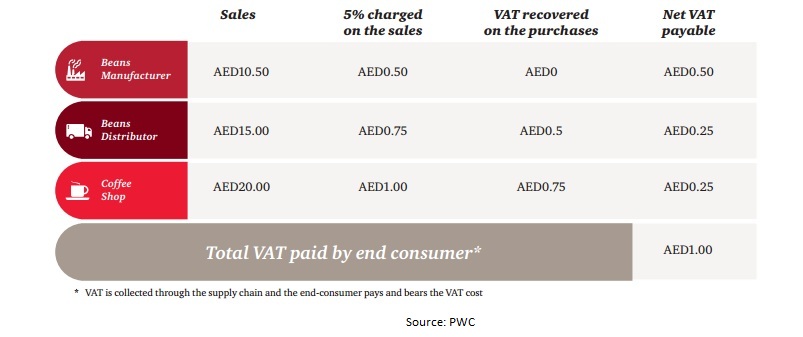

The VAT is a consumption tax, added to each stage of the supply chain. Businesses and individuals with business activity exceeding the mandatory VAT registration threshold specified by domestic legislation will register for VAT. The VAT registered businesses will charge the consumers and customers at tax on the goods and services supplied as well as pay taxes for any goods and services received from suppliers. Businesses, therefore, act as a tax collector for the government where VAT is ultimately paid for by the consumers.

While it is likely to be applied to most goods and services, there are bound to be some exceptions. A variation exists between what each country chose to exempt; some common examples include, basic food items, essential medicines, and exports of goods and international services are all expected to be zero rated supplies. Healthcare, education, sale or lease of residential property, and finance and insurance are mostly likely to be tax exempt as well. About a 100 staple food items will be exempt from VAT.

It is however important to note the distinction between zero rated and tax exemption. Tax exempt businesses will not be able register for VAT and reclaim any tax differences on their purchases while businesses that are subject to a zero-rate tax may be entitled to register for VAT and recover VAT on their purchases.

Effect on the Economy

It is expected that, with the VAT, inflation will soar by as much as 1.4 % and will generate as much as $25 billion in annual tax revenue. The exact scope and impact of the tax on GCC member countries is yet to be determined given that only the UAE took active steps to implement it.

To shed some light on the tax, the UAE Ministry of Finance held a VAT briefing session in March of this year. The UAE confirmed that gold, silver, and platinum investments will be zero-rated. It is likely the remaining GCC countries will follow suit, given the competitive advantage of zero or low tax to potential investors. Gold jewellery, on the other hand, will be subject to VAT in the UAE.

The commodities market, even if zero-rated or tax exempt, will be impacted with the added taxation. Industries which require significant capital for daily operations such as, agriculture, mining, and energy, will most likely cover the tax as VAT input. Thus, for producers and businesses eligible for the VAT refund, cash flow issues could seriously impact performance. Retail price of commodities may rise above 5% if businesses decide to the use the VAT to mask inflated costs.

Differences in adoption method

While all GCC members have signed the agreement to adopt the tax, simultaneous implementation of all the members may prove to be too difficult given all the necessary legal work involved in the process. So far only UAE has approved a draft federal law regarding the taxation procedures and hosted a briefing session for all those involved.

In the UAE, approximately AED 12 billion ($3.2 billion) is expected in revenues upon the introduction of the tax, according to a report by Dubai-based daily Gulf News. The tax revenue would amount to 0.9 % of UAE’s gross domestic product (GDP). All companies with annual revenues exceeding $100,000 will register for the tax with a projected 95% compliance rate in the initial stage. Voluntary registration threshold will be $50,000.

The following are some of the preliminary details around the VAT revealed in the Ministry of Finance VAT awareness session held in March, all pending the law’s final approval.

Commodities and services subject to zero tax rate in the UAE include: Healthcare and education; basic food items agreed on by all GCC members, although UAE intends to subject these food items to the standard rate of VAT; a list of medicine –pending GCC approval—and medical equipment; investment gold, silver and platinum

The UAE has exempt the following from VAT: Sales and leases of residential property; life insurance will be exempt from VAT; local transport, such as taxis, buses, trains, etc.

Commodities and services subject to a 5% VAT in the UAE include: Financial services, which will be subject to a narrow exemption model; sales and leases of commercial property; all non-life insurance products; Islamic financial products.

In the first year of implementation, Kuwait expects to collect 1.4% of GDP and Saudi Arabia expects to collect about 1.6% of its GDP. For Qatar, revenue from VAT may amount to about 1.5% of its GDP. The finer details of the tax and its legislation are still underway in all of the GCC countries; it will be an immense challenge for businesses and tax administration to implement it within the specified time frame.

Bahrain, UAE, and Saudi Arabia have all announced their intent to enforce the tax by January 2018, putting pressure on the other GCC members to hasten implementation to avoid negative impact on GCC as a whole.

Impact on Investment, Profit, FDI

VAT is easy to administer and enforce as businesses will be collecting the tax on the government behalf. The low rate of 5%, compared with the global average of 15%, the VAT recovery mechanism for businesses, and some industry exemptions translates into minimal impact on foreign investment and economic activity in general.

Many sectors will be subject to a zero rate, such as the health care, education, and property development, and hence businesses and customers in these sectors will not be affected. The reduced registration threshold, for both mandatory and voluntary VAT registration, will enable many small and medium sized companies to register and recover VAT.

Most businesses will face significant compliance costs especially given that the VAT will be introduced from January 1, 2018. To make matters worse, legislation hasn’t been ironed out yet making the situation murky for businesses – the ultimate collector of VAT. In a few weeks time, as laws are drafter and the finer details ironed out, the true impact of the law will be clear for all stakeholders.

Looking forward

Globally, more than 150 governments have implemented the VAT or its equivalent, Goods and Services Tax, including all of the European Union members, Canada, New Zealand, Australia, Singapore, and Malaysia. Charged at each step of the supply chain, the tax is meant to broaden the government tax base with consumers, suppliers, and business owners chipping all contributing.

The dip in oil prices has made the tax an appealing source of revenue for all the GCC countries. The UAE has made significant strides in putting the law in place, making it easier for the remaining countries to follow suit. For VAT revenues to bear fruit, a high compliance rate is needed from businesses with the countries governing the overall structure.

By Heba Eid