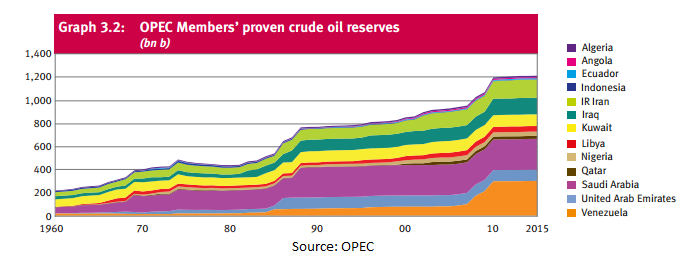

Riyadh – Decypha: Saudi Arabia, has long been viewed as the kingdom of oil, with the land area of about two million square kilometres and the second largest oil reserves in the world with about 261.1 billion barrels of oil, about ten times those of ExxonMobile, the largest private oil company. The country has been publicly struggling to shake off the effect of the turbulent oil prices, not only to stabilize its economy past the shock it encountered but to secure itself against future oil volatility.

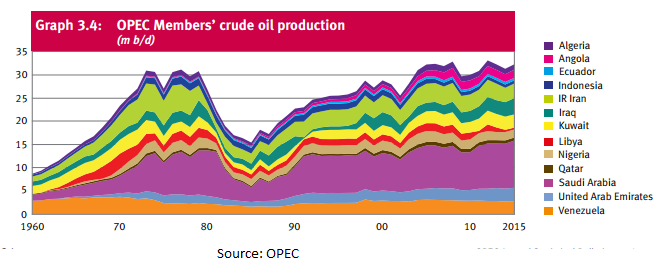

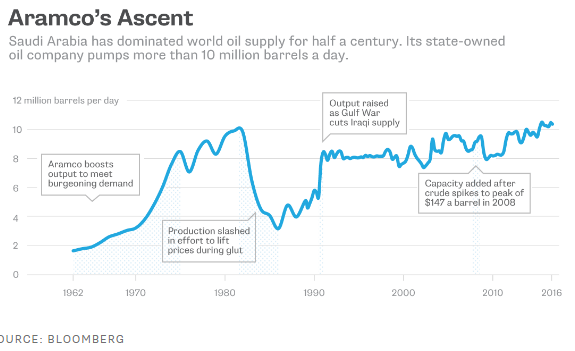

Approximately one of every nine barrels of global production is extracted from Saudi Arabia, at about a third of the cost compared to the United States. In 2015, Saudi Arabia was the top producer of oil at 10.19 barrel per day (bpd), followed closely by Russia at 10.11 million bpd, and the US at 9.43 million bpd. The ease of pumping oil in Saudi Arabia has made it the lowest-cost oil producer in the world.

Plummeting Oil Prices

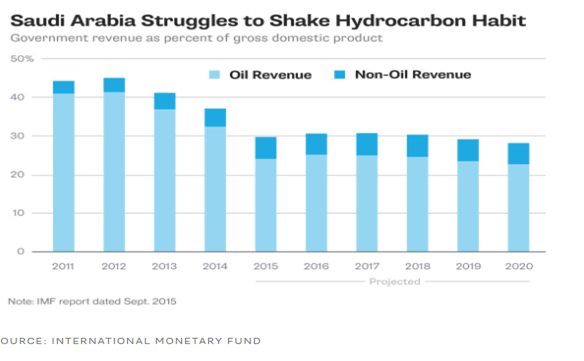

The hydrocarbon industry accounts for about 50 % of the Kingdom’s gross domestic product (GDP) and approximately 85 % of export earnings. As the largest exporter of petroleum globally, the country’s economy suffered a massive blow with the plummeting oil prices. Although the nation, as a swing producer, had a hand in engineering lower oil prices in a bid to maintain its share of global energy prices.

The oil-rich nation generates approximately 90% of its revenues from oil and hence the collapse of oil price to below $35 a barrel wreaked havoc on the country. With a public-sector spending on wages and foreign aid ballooning the budget to 15%, and the country burning through currency reserves at a fast pace, the political upheaval of funding rebels in Syria’s civil war, and leading airstrikes against Yemeni insurgents – all contributed to the country’s financial woes in the form of a $200 billion budget shortfall.

The economic realities are dictating change. For the first time in 15 years, the government has secured a $10 billion loan. Furthermore, in an effort offset the kingdom’s financial strain, Deputy Crown Prince Mohammed bin Salman is spearheading a campaign to balance the budget, increase government coffers, and enhance the productivity of the country’s citizens.

Production

Saudi Arabia’s crude oil production in 2015 was approximately 10.2 million bpd, with a cumulative production of around 140 billion bpd. In 2000, the country’s daily production was 8.094 billion bpd and 91 billion barrels cumulative.

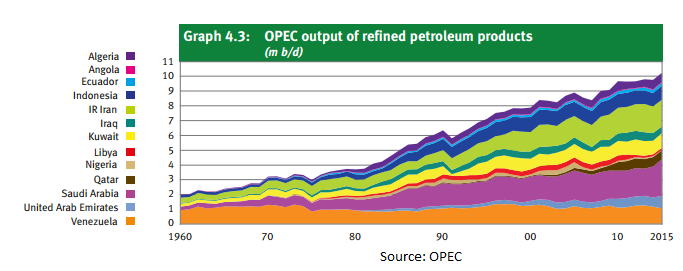

In 2015, the recorded proven oil reserves for Saudi Arabia was 266,455 million barrels compared to 266,578 million barrels in 2014. For 2015, output of refined oil productions was 2.48 million bpd. The country had 145 active rigs in 2015, down from the 148 rigs recorded in 2013, and a notch up from the 121 rigs in 2011.

Exports

Sitting on top one of the largest and easy to produce crude oil reserves, the nation exports most of the oil produced. In 2015, the country’s total value of exports was reportedly $205.45 billion, out of which $157.962 billion were petroleum exports.

The top importers of oil from Saudi Arabia are the Asia and the Pacific with 4,592 million bpd imported in 2015, followed by North America at 1,190.8 million bpd. Europe imported 877 million bpd and the Middle East, Africa, and Latin America imported 286.3 million bpd, 147 million bpd, and 70 million bpd.

When it comes to the Kingdom’s export of petroleum products, Asia and the Pacific still top the list in 2015 with 578,900 bpd followed by the Middle East at 195,800 bpd, and Africa at 195,000 bpd. About 180,700 bpd worth of petroleum products is imported by Europe and 4,100 bpd imported by Latin America. North America does not import any petroleum products from Saudi Arabia.

The value of petroleum exports has, over the past five years, peaked in 2012 at 337,480 million. From 2013 onwards, petroleum exports have been declining with 2013 registering 321,888 million, 2014 registering 284,424 million, and 2015 157,962 million.

Oil exports into the European market has long been dominated by Russia, but as the rivaling country focuses more on boosting its exports to Asia, a gap has presented itself to Middle Eastern countries. A fact which led the Saudi state to change it’s pricing method for oil exports to European countries from the Brent Weighted Average (BWAVE) to the ICE settlement for the Brent benchmark.

While, both price references are part of the Brent benchmark which is used as a price base for most of the world’s crude; the move, which is expected to take effect July 1st will enhance the appeal of Saudi oil thought easing the purchase process, and allowing buyers to hedge better.

Amount going into petrochemical industry

Some of the petroleum products produced by Saudi Arabia are gasoline, kerosene, distillates, residuals, and others. Distillates had the lion’s share of production in 2015 at 962,900 bpd, followed by gasoline at 492,000 bpd, residuals at 447,000 bpd, other products at 366,900 bpd, and kerosene at 210,800 bpd.

Aramco: Kingdom’s Hydrocarbon Giant

The Saudi Arabian Oil Company, better known as Aramco, is the state-owned world’s number one oil producer with more than 12 million barrels pumped per day. Also as the world’s fourth biggest refiner, Aramco controls the world’s largest oil reserves, behind Venezuela. The oil obtained in the Kingdom’s is, compared to Venezuela, cheap and easy to obtain.

As the nation’s patrimony, Aramco has more than 60,000 employees and operates numerous subsidiaries and affiliates in China, Japan, India, South Korea, Singapore, Egypt, the United Arab Emirates, the U.K., the Netherlands, and the U.S.

About 90% of the government income is generated by Aramco. The state-owned company built the refineries, petrochemical plants, and other infrastructure – all of which form the backbone of the Kingdom’s economy.

Estimates of its value vary from $400 billion to more than $2 trillion – almost three times the size of Apple. The exact figures of the company’s financial performance are not available given the profits are shrouded in secrecy. To prepare the country for the post-hydrocarbon age, the Saudi Arabia government is planning a partial privatisation of the Aramco.

Aramco’s IPO

In 2018, the government plans to sell up to 5% of Aramco in the world’s largest public offering. Various estimates value the sale from $20 billion to $100 billion. Proceeds from the IPO will fill a sovereign wealth fund, driven by the government’s push to diversify the economy. The company is considering on listing its shares on two or three exchanges and selling its shares in London, New York, Tokyo, Singapore, Hong Kong, Canada, in addition to the domestic market. Aramco’s tax rate may be reduced to make the sale more attractive to investors.

A number of Aramco’s subsidiaries will be offered to the public, in addition to the mother company. The government plans to introduce a new strategy to transform the company into an energy and industrial company versus the current oil and gas one. The IPO’s main purpose is to diversify income and decrease the economy’s dependence on oil.

Prince Mohammed bin Salman, the king's son and influential deputy crown prince, plans to plough the proceeds from the IPO into various projects, all to wean the Saudi economy off crude oil as its main benefactor.

Future

As a nation highly dependent on crude oil for its livelihood, country future plans dictate otherwise. Prince Mohammed unveiled the Kingdom’s Vision 2030 and National Transformation Program (NTP) 2020, both of which encompass broad economic and social changes. The Aramco’s IPO is a tectonic move from the government to catapult the nation into an era beyond oil. The prince’s vision for the Kingdom in the next 20 years – a state that doesn’t depend on oil.

A string of economic reform policies has been put in place such the reduction in gasoline, electricity, and water subsidies. Discussions are underway on a value-added tax and levies on luxury goods and sugary drinks, as well as studying the complete or partial privatisation of over two dozen agencies, including the national airline and telecoms firm – all to generate $100 billion a year in nonoil revenue by 2020.

By Heba Eid