Cairo – Decypha: Construction has long been a pivotal force and the largest sector in the GCC region. Approximately, $500 billion worth of civil construction projects have been awarded in the six states since 2006. Nonetheless, the sector has seen a slowdown in the past 12 months, yet it remains poised for growth with robust project pipeline of USD 2 trillion to be awarded from 2017-2020, according to PRN.

With the MENA region heavily reliant on the hydrocarbon market, the recent plunge in oil prices have left the GCC countries scrambling to restore government coffers to its heyday. Now GCC countries are scrambling to diversify income and have shelved many unwanted projects.

Prior to the global oil glut, price of oil per barrel was around $100, and has significantly dropped to a low of $30 per barrel at some point with 2017 boasting a recovered oil price in the mid-fifties range. The thriving oil prices have reaped benefits across many industries in the region, including the construction industry.

The GCC countries have long enjoyed a robust construction sector but with the hydrocarbon sector in peril, all industries have suffered. With government revenues halved, there were strict limitations on capital spending. Governments and other client bodies across the region have curbed spending, with the focus now on means of diversifying income, and projects which don’t fit the criteria postponed or shelved. In addition, projects and payments have been delayed. This new reality has negatively impacted construction firms, as most firms rely on government business for their cash flow. In particular, Saudi Arabia, Oman, and the UAE were affected the most by the delay in payments from government clients, with the cash flow crunch forcing thousands of layoffs according to the Outlook for GCC Construction 2017 report.

Companies have been forced to reduce capital, bring in new strategic investors, and offset losses with reserves. To put a figure on it, in 2016 construction companies across GCC witnessed a 3% further increases in losses compared to 2015, with recorded losses of $1.22 billion in 2016 compared to $1.18 billion in the previous year.

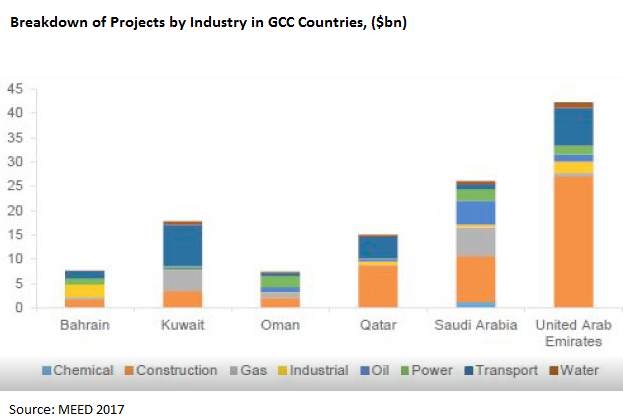

Performance of Different Countries

While the drop in oil prices had a negative impact on government spending, there were some countries that performed remarkably well. Dubai, Kuwait, and Bahrain have thrived in the past 12 months, particularly Bahrain. In 2016, Bahrain saw its second-best year for awards since 2007, owed in part to the financial support of its GCC partners through the Gulf Development Fund.

Saudi Arabia: As the largest producer of oil in the GCC with the biggest construction market on basis of contract awards, the Kingdom’s fiscal deficit soared to $98 billion in 2015 from $15 billion in 2014. The oil price has severely impacted the country’s economy and consequently the construction sector suffered with many cutbacks, project delays, and cashflow problems. Saudi Arabia contract awards dropped by 62% in 2016.

The Kingdom has a pipeline of megaprojects with more than 80% of the investment flowing through these multi-billion dollar projects. The projects include $97 billion Saudi Arabia Rail expansion program, $150 billion KACARE Renewable Energy Program, and $70 billion KACARE Nuclear Power Reactor. The Kingdom’s National Transformation Program will see more investments in the construction sector.

UAE: Abu Dhabi and Dubai own the lion’s share of the nation’s construction sector.The Dubai 2020 expo event has fueled the construction sector in the Emirate where the government setting aside DH 17 billion in 2016 budget for infrastructure development till 2020, covering housing, roads, railways, schools, and public buildings. Abu Dhabi has earmarked $100 billion for investments till 2030 to be ploughed in the real estate and construction sector.

Qatar: As the host country of FIFA 2022, Qatar has invested in the development of the required infrastructure of the last few years. The country awarded projects more than $50 billion since it won the FIFA bid in 2022, with infrastructure projects including stadiums, hotels, and other transport facilities. It is expected the country will award more projects in the years to come.

Performance of Construction Companies

Five of the eight listed construction contractors in the GCC have reported losses, namely Arabtec, DSI, Al Mojil Group, Galfar Engg, and DEPA, according to the report GCC Construction Companies Downtrend Continues by Ubhar Capital. Al Khodari, CGC, and Nass Corp were profitable in 2016. The profitable companies are either diversified in their revenue streams or have lower operation costs, such as lower oil prices to break even. The accumulated losses for the companies rose from $1.45 billion in 2015 to $2.41 billion in 2016, a 65% increase.

Equity, Assets, and Debt

Due to the rising accumulate losses, shareholders’ equity of the GCC construction firms decreased by 64%, from $1.91 billion in 2015 to $694 million in 2016, according to Ubhar’s Capital Report. Companies’ assets have also dropped by 11%, from $9.871 billion in 2015 to $8.79 billion in 2016. The companies’ debt has continued to rise for almost all the listed firms, reporting a 9.5% growth in their debt obligations, from $2.71 billion in 2015 to $2.97 billion in 2016.

Customer receivables, unsettled transactions or other obligations owed to a company by its customers, dipped about 5% in 2016 compared to the previous year, yet receivables as a percentage of assets rose about 3% in 2016. The debt to equity ratios for all the firms rose from 1.4x in 2015 to 4.3 in 2016 due to the drop in equity and rise in debt. Furthermore, by the end of 2016, cash and bank balances of the construction firms were approximately 0.9x of equity and only 0.15x of the receivables at $639 million, according to the same report.

Future Outlook

Despite the slowdown in project spending, the region’s construction sector is poised to improve in 2017, experts believe that the worst is over for the sector, according to a report by MEED released in March of this year.

Kuwait’s $12.2 billion airport expansion project, construction work for Dubai’s Expo 2020, and Saudi’s 2030 Vision and National Transformation Program are all positive signs of a brightening future. Plans to double infrastructure and transport spending in 2017 have been announced by the Saudi government and the upcoming years will be about implementation.

The rise in oil prices has somewhat eased the pressure off government finances, yet all GCC governments want to increase private sector investment to ease the burden of capital spending. Economic reforms, new forms of project model such as public private partnerships (PPP), and new revenue streams will all serve to clear up payment arrears, according to the MEED report.

How well the construction sector recovers depends on how and when the governments of the region implement economic reform. Furthermore, any reform put forward will take time to kick in. Take PPP for example. PPP’s success has been limited in the past and, going forward, there will be challenges to be addressed for it to bear fruit. The decrease of new opportunities and the uncertain project timelines will see a further hardening of construction companies in response to increased competition.

Wherein the future for the construction sector in GCC is still hazy, the outlook is brightening. While it may take a while for the industry to recover to its pre-2008 highs, it is on the road of recovery, despite some of the challenges ahead. Oil price estimates puts the barrel for the 2017 and 2018 at around $60; much improved than the low of $30 recorded in the past two years. It may be that the worst is over, construction companies are not completely out of the woods yet.

By Heba Eid