Dubai – Decypha: In the aftermath of oil price crisis, the UAE has been struggling to maintain its financial stability and to provide an environment of continued economic for businesses. Despite the challenges faced in UAE and the region, the country’s insurance sector has seen a boom in the past five years which necessitated a new federal law to regulate the insurance sector.

“The rapid urban growth taking place in the UAE has reflected positively on the insurance sector as insurance premium rates increased in number and volumes, which necessitates a more robust legislative base to accommodate new developments and to ensure more resilience for this significant sector,” said Salim Abdullah Al Shamsi, Head of the Committee on Financial, Economic and Industrial Affairs of the Federal National Council.

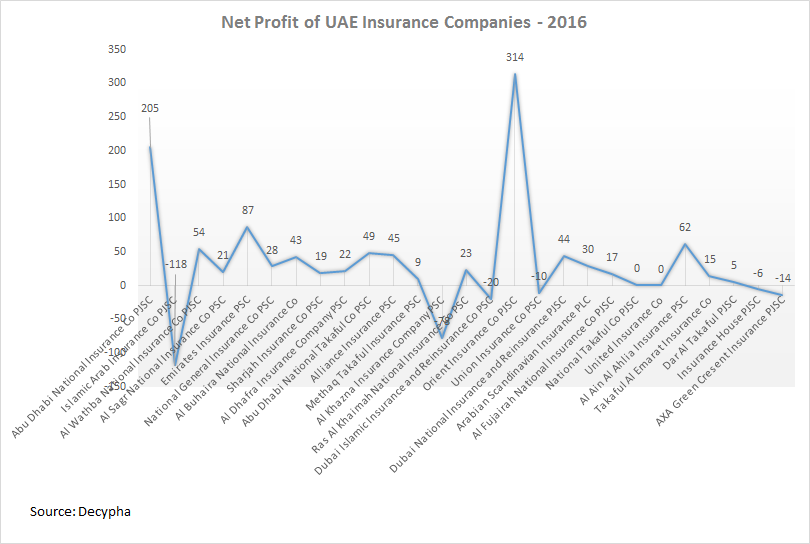

UAE’s insurance sector has numerous domestic and international companies. A closer look at the companies financial results show the upward trend and growth of the insurance industry in the market.

Profitable Companies

Abu Dhabi National Insurance Company performance results for 2015 revealed net losses of AED 334.5 million in 2015 and AED 205 million net profit in 2016, a 160% turnaround for the company.

Al Wathba National Insurance Company’s net profits to AED 18.1 million in 2015 and AED 54.37 million in 2016, almost 200% increase in its profits.

Al Sagr National Insurance Company had a profitable year in 2016 compared to the previous year. Net losses for the company in 2015 was recorded at AED 105 million. The following year deemed profitable for the company, with net profits recorded at AED 20.7 million.1

Emirates Insurance’s net profit for 2015 amounted to AED 89.63 million and AED 87.17 million in 2016, showing a 2.73% decline in profits.

The National General Insurance company’s net profit for 2015 was estimated at AED 23.5 million. In 2016, the company displayed a 20.9% increase in profits with profits recorded at AED 28.43 million.

Al Buhaira National Insurance company’s performance improved by 25% in 2016 compared to the previous year. Net profits for the company amounted to AED 34.1 million and AED 42.72 million for the years 2015 and 2016, respectively.

The Sharjah Insurance Company accrued net losses of AED 13.21 million in 2015 but rebounded in 2016 where net profits for the company stood at AED 19.3 million.

Losses for Al Dhafra Insurance Company amounted to AED 61.4 million in 2015. Results for the company in 2016 were in the positive with the company’s net profits were AED 21.8 million, an increase of 135% year-on-year.

Abu Dhabi National Takaful Company’s net profit for 2015 and 2016 totalled AED 41.5 million and AED 49 million, respectively, amounting to an 18% increase in profits.

Alliance Insurance company’s performance improved by 2.5% from 2015 to 2016, with total net profits recorded at AED 44 million and AED 45 million, respectively.

In 2015, Methaq Takaful Insurance net losses amounted to AED 3.51 million. The company’s performance took a turn for the better in 2016, where the company recorded profits of AED 9.32 million, marking a 365% growth.

Ras Al Khaimah National Insurance’s performance slightly improved in 2016. Total net profits in 2016 were 1.28% higher in 2016 versus the previous year, with profits estimated at AED 23.1 million and AED 23.39 million for 2015 and 2016, respectively.

The performance of the Orient Insurance Company improved by approximately 15% in 2016 where net profits for 2015 and 2016 were AED 272.03 million and AED 313.84 million, respectively.

Dubai National Insurance and Reinsurance registered net profits of AED 40.81 million in 2015 and AED 44.03 million in 2016, a 7.89% increase in company’s profits.

In 2015, Arabian Scandinavian Insurance’s net profits were AED 13.46 million which grew to AED 29.84 million in 2016, a growth of 121% year-on-year.

Net profits of Al Fujairah National Insurance Company were estimated at AED 14.33 million and AED 17.37 million for 2015 and 2016, respectively, marking a 21.1% growth of profits for the company.

National Takaful Company accrued net losses of AED 41.38 million in 2015 and recovered in 2016 to achieve a net profit of AED 385 thousand.

Net losses for United Insurance Company in 2015 were AED 64.82 million. The company rebounded in 2016 with net profits amounting to AED 237 thousand in 2016.

Al Ain Al Ahlia Insurance’s performance has been positive for the past couple of years. In 2015, the company’s net profit stood at AED 20.65 million and in 2016 its profits were AED 62.3 million, almost 200% growth in profits.

Takaful Al Emarat Insurance Company achieved a 45% growth in profits in 2016 compared to the previous year. Net profits for the company were AED 10.2 million and 15 million in 2015 and 2016, respectively.

Dar Al Takaful has been able to bounce back from losses to profit from 2015 to 2016. In 2015, the company had net losses of AED 7.14 million but was able to attain AED 5.02 million in profits in 2016.

Companies with Reported Losses

The past two years has been unprofitable for Islamic Arab Insurance Company. In 2015, the company recorded losses of AED 79.1 million and in 2016, the company’s losses further declined by 50%, with losses recorded at AED 118.3 million.

The two years, 2015 and 2016, were unprofitable for Al Khazna Insurance Company. The company’s net losses were AED 59.67 million and AED 77.7 million for 2015 and 2016 respectively, showing a 30% decline in the company’s performance.

The Dubai Islamic Insurance and Reinsurance’s performance took a massive hit in 2016, with a decline of about a 1000%. The company’s net profit for 2015 was AED 2.18 million and in 2016 the company registered a significant net loss of AED 20 million.

Losses further deepened for Union Insurance in 2016. In 2015, losses accrued by the company was AED 4.73 million and AED 10.43 million in 2016, a steep decline of 120%.

Although 2015 and 2016 have been unprofitable for Insurance House, losses for the company have been reduced by 60% in 2016. Losses for the company were recorded at AED 14.2 million and AED 5.71 million for 2015 and 2016, respectively.

AXA Green Cresent Insurance accrued losses for both 2015 and 2016. In 2015, losses for the company amounted to AED 15.44 million and for 2016 losses fell by 10% to AED 13.91 million.

Reading the Figures

The year 2016 has been good to the insurance sector in the UAE. Most of the insurance companies, with the exception of a few, reported positive net profits compared to 2015. Some companies were unprofitable in 2015 but were able to recover in 2016 and register profits, such as Abu Dhab National Insurance Company, Al Sagr National Insurance Company, Sharjah Insurance Company, Al Dhafra Insurance Company, Methaq Takuful Insurance, National Takful Company, United Insurane Company, andDar Al Takful Company. Only a handful of companies have been reported net losses for two years in a row, namely, Green Cresent Insurance, Insurance House, Union Insurance, Al Khazna Insurance Company, and Islamic Arab Insurance.

Editorial note: All data mentioned above has been collected and processed by Decypha’s financial analysts from official statements. Figures here only represent listed companies, and therefore may present a limited picture of the industry.

By Heba Eid