Cairo – Decypha: Approximately three percent of the global construction materials is used up by the GCC, which includes stone, bricks, cement, concrete, glass, steel, and aluminium. The cement market, in particular, is considered a lead indicator for the health of the construction activity in the region.

Worth $4 billion, the cement industry across GCC accounts for about 20% of the total value of building materials sold today. Furthermore, the demand for the commodity has grown by 6% over the last five years, according to figures by Global Cement.

About 84% of the total GCC demand for cement comes from Saudi Arabia and United Arab Emirates (UAE). The increase in local demand is a positive sign of the industry’s overall improvement, compared to the previous decade where oversupply and shrinking demand has led to aggressive exporting to Africa and Iran.

The cement market in the GCC is poised for growth up to 2019, according to the report Cement Market in the GCC 2015-2019. Numerous factors will propel the cement market forward such as the rise in population, increase in tourists, demand for affordable houses, and new cities development.

Other factors expected to contribute to market growth are the region’s investments in the transportation sector. New railway networks, seaports, airports across the region will increase the demand for cement in upcoming years, forecasted the Cement Market in the GCC 2015-2019 report.

UAE: The Strongest Member

As the second largest economy in the GCC, the UAE is one of the leading cement producers in the region and has the largest construction market in the GCC. Before the economic downturn of 2008-2009, Dubai accounted for 25% of all construction in the world.

UAE has the cement capacity of 41 metric tons, with domestic demand of 21 metric tons, according to estimates by Reuters. Almost half of the cement produced is exported to neighboring countries such as Oman, Egypt, and other African countries, according to Technavio. The gap between supply and demand in UAE has negatively impacted profitability of its cement suppliers.

Cement export will decrease over the coming years to meet the rising local demand, according to Technavio Research. Analysts at Technavio predict a 7.56% growth of cement market in the country in the period of 2014-2015. The UAE government plans to invest around $700 billion in the country’s infrastructure development over the next 15 years. Dubai Expo 2020, UAE National Vision 2021, transport and power infrastructure investment, and major construction project are all contributors to the cement’s increasing cement demand.

In addition, the economic revival of the nation and rising optimism are cause many to restart stalled projects. Constructions in institutional, residential, and industrial sectors are expected to accelerate over the next five years.

While outlook of the cement market in UAE seems to be promising, the low oil prices have taken its toll on the UAE economy, and private companies are feeling the crunch, revenue wise. Several producers’ revenue levels declined in 2016. Arkan cement, for example, reported a drop in tis revenue by 9% year-on-year (YoY) in 2016 and net profits fell a drastic 25%. It, therefore, comes at no surprise that the company closed its Emirates Cement plant in Al Ain. Fujairah Cement revenues declined by 2.5% and Union Cement’s revenues dropped by 10%.

Saudi Arabia: The Highest Potential

The construction market in Saudi Arabia is one of the largest in the region, with the rising population and expatriate growth continuously fueling the need for more housing. T e kingdom’s population is expected to increase by 23% over the next ten years. The Kingdom is introducing a new major housing plan, which will boost demand for building materials, including cement. Construction of key downstream chemical plant are factors contributing to construction material demand growth.

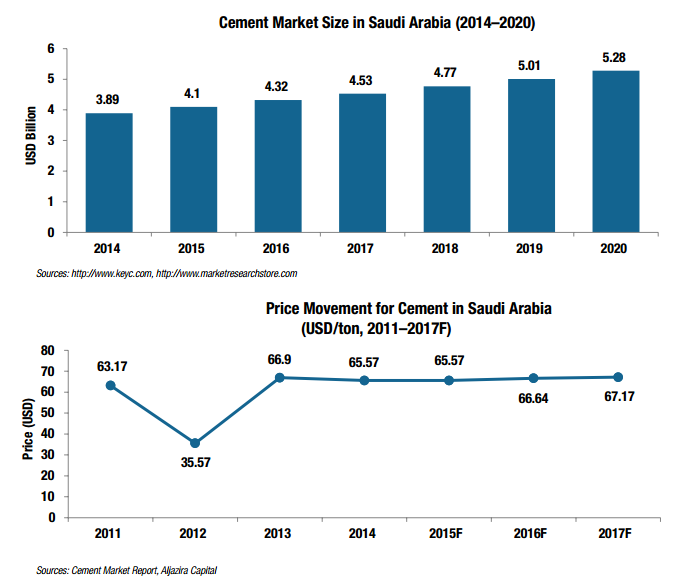

It is expected that the construction sector will grow at a compound annual growth rate (CAGR) of 7.05% until 2020 and the cement sector is estimated to grow at CAGR of 5.14%, according to Saudi Arabia - Industrial Sector Overview Report. The cement market in the Kingdom is expected to reach approximately $5.27 billion by 2020, according to Cement Market Report by Aljazira Capital.

Numerous factors contribute to the expected construction sector and cement market growth which include the increased investment in the transportation sector, government’s decision to develop the tourism sector which translates into more investment in the hospitality segment and infrastructure construction.

Cement sales performance has been healthy in the first four months of 2016, with a 0.8% YoY increase to 22.5 million tons. The cement market landscape in Saudi Arabia is driven by the Central province, expected to rapidly grow compared to West and East, followed by Western, Eastern, Southern, and Northern provinces.

Saudi Arabia’s cement market is dominated by numerous large players which include Yamama Cement, Arab Cement, Saudi Cement, Southern Cement, Eastern Cement, Tabuk Cement, Qassim Cement, Riyadh Cement, Yanbu Cement, and Narjan Cement. Saudi Cement is one of the largest and most profitable in the GCC region, with low energy costs contributing to their profitability.

Profit margins have declined in the past year, leading many cement companies to not pay their dividends namely Saudi, Southern, and Qassim Cement. Some experts project that the downward trend in the sector will result in further cuts in dividends.

The Remaining GCC States

With a pipeline of major projects under its belt, construction, and accordingly, cement market is robust. Early in 2017, the Kuwaiti government has awarded $4.6 billion worth of contracts, with another $20 billion worth of contracts expected before the year’s end, according to Construction Week. Currently, construction in Kuwait accounts for about 2% of its GDP.

As a major oil producer, Oman’s hydrocarbon sector accounts for 51% of its GDP and the construction sector accounts for about 5% of its GDP. It’s expected that over the next five years, most of the construction work will be oil related.

Construction sector accounts for about 11% of Bahrain’s GDP with most of the market and its growth is due to infrastructure and housing projects.

The 2022 FIFA World Cup and all of the infrastructure expansion plans will increase demand for building materials, particularly cement, in Qatar over the next few years.

Key Players across the Region

Large players in the industry, such as Gulf Cement and Kuwait Cement companies dominate the GCC market. Other important players include Lafarge, Oman Cement Company, Qatar National Cement, Saudi Cement Company, Al Safwa Cement, Aljabor Cement Industries, Eastern Province Cement, Fujairah Cement Industries, Jebel Ali Cement, Khalid Cement Industries Complex, Najran Cement, National Cement, Pioneer Cement, Ras al-Khaimah Cement, Southern Province Cement, Tabuk Cement, Teba Cement Factory, Yamama, and Yanbu Cement.

The cement industry in the region is as robust or as weak as its construction sector, which is steadily recovering from the real estate crash and economic recession of 2009-2010. Saudi Arabia is projected to be the largest market in the next few years with increasing investments in the transport and residential infrastructure sectors propelling the market forward. The UAE, with Dubai 2020 World Expo, will own contribute to the construction sector growth. Same goes for Qatar, with the FIFA World Cup in 2022. All these projects are to contribute five percent annual growth over the next five years. However brightening the outlook is for the construction sector and cement industry, cement producers need to improve their competitiveness, increase exports, and save on production costs – all to safeguard against the uncertainty of the region’s continued reliance on the hydrocarbon industry.

Heba Eid